The pension system is facing a growing crisis, Central Bank Governor Dr Kevin Greenidge warned Tuesday, with more than 28 per cent of defined benefit plans underfunded and an average funding rate of just 84.1 per cent.

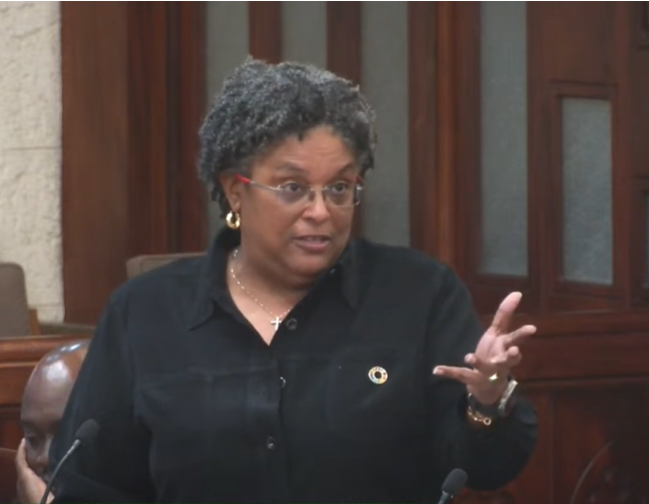

Addressing the Eckler Annual Pension Investment Conference, he pressed for urgent reform and innovation to ensure the system’s sustainability as Barbadians live longer in a shifting economy.

Greenidge emphasised the challenges facing the pension industry, particularly the impact of an ageing population and declining birth rates. “If our pension system is to remain a reliable source of financial security for retirees, it must adapt to changing demographics and economic conditions,” he said.

“Over 28 per cent of defined benefit plans remain unfunded, with an average funding rate of 84.1 per cent. That must be addressed. Couple this with a declining birth rate, and the long-term sustainability challenges become clear.”

The governor highlighted opportunities for pension funds to play a transformative role in national development. He encouraged stakeholders to consider strategic investments in key areas such as climate resilience, affordable housing, and green technology, which align with national priorities and promise stable long-term returns.

“A growing economy creates fertile ground for strategic investment by pension funds,” Greenidge said. “Investments in climate resilience and sustainable infrastructure not only provide stability but also address critical social and environmental needs, such as achieving our net-zero carbon goals by 2035.”

He also pointed to government-led initiatives such as the Barbados Optional Savings Scheme Plus (BOSS Plus) as secure options for pension funds to grow assets while bolstering economic growth.

“BOSS Plus offers a 4.5 per cent return, presenting an opportunity for pension plans to strengthen their portfolios while contributing to economic growth,” Greenidge shared.

While commending the economy’s resilience, marked by a 3.9 per cent growth in the first nine months of 2024, a $581.9 million primary surplus, and $3.2 billion in international reserves, the central bank governor cautioned that these gains must be complemented by pension industry reforms.

He said: “Pensions are far more than financial instruments. They are a promise of security and dignity for all retirees. To fulfil that promise, we must strengthen governance, improve financial literacy, and embrace innovation. This is a shared responsibility, one that demands resilience, collaboration, and forward-thinking.” (SM)

The post One in four pension plans underfunded appeared first on Barbados Today.